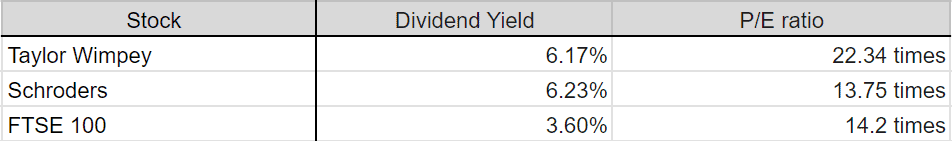

I’m searching for more high-yield dividend shares on the FTSE 100 to beef up my passive income portfolio. But the yield alone isn’t everything — I’m also looking for ones with rock-bottom price-to-earnings (P/E) ratios. Undervalued stocks with high yields offer the perfect combination of growth and value.

Taylor Wimpey (LSE: TW.) and Schroders (LSE: SDR) have caught my attention. They’ll probably be among the top 10 dividend-paying shares on the FTSE 100 soon since Vodafone and Burberry will cut dividends from next year.

But are they both worth buying?

Yield-wise, they’re almost identical, both around 6.2%. Taylor paid a 9.58p dividend per share last year, up from 9.4p in 2022. It was reduced in 2019 to 3.84p but has otherwise been increasing steadily since 2011. Before 2008, the housebuilder paid a 15.75p dividend but was forced to cut it completely for three years.

Should you invest £1,000 in Hurricane Energy Plc right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if Hurricane Energy Plc made the list?

Schroders’ dividend was 21.5p last year with no change from the previous year. It didn’t cut or reduce dividends during the 2008 financial crisis or Covid (although growth did pause). Overall, the asset manager has a solid 15-year dividend growth rate of 9.61%.

From this data, I can see that Schroders is a more reliable dividend payer while Taylor Wimpey recovers rapidly after cuts.

Value-busters

When it comes to value, the winner’s clear. Based on future cash flow estimates, Taylor is undervalued by only 11%. It also has a high P/E ratio of 22.2, higher than both the UK market and industry average.

Schroders’ P/E ratio of 14.4 is far more attractive, below both the UK market and its industry average. What’s more, future cash flow estimates put Schroders’ share price at 40% below fair value.

Price growth

Dividends aside, will either of the shares net me significant returns?

Here I see a huge discrepancy. Taylor climbed 34% between August 2023 and August 2024, while Schroders fell 20%!

On one hand, that doesn’t look great for the asset manager — but it could mean the current price has more room to grow. The housing giant, on the other hand, is near its highest price in three years.

But what really makes a difference here is industry-specific risk. Looking back 20 years, Taylor’s down almost 18% because the stock was decimated by the housing crisis in 2008. Schroders barely registered the crash and subsequently grew 238% in the two decades preceding August 2024.

Future prospects

As a housebuilder, it’s more susceptible to UK interest rate changes and local economic issues. The new Labour government’s housebuilding plans are likely to keep it in high demand. But an economic upset could send it tumbling again.

Schroders is more tied to global financial markets and less prone to local volatility. While growth of late has been negative, it’s more consistent over long periods. However, this does mean it could suffer losses even when the UK economy’s doing well.

Overall, I think the reliable payments and a stable price make Schroders a better choice than Taylor Wimpey for me for passive income. So I plan to buy it for my dividend portfolio when I next have cash to invest.